Jan 12, 2024

Insights

4 min

Eterna's Insights - December 2023

To receive our Insights newsletter you can sign up here

Key Takeaways:

Crypto exchange volume surpassed $1tn

Spot Bitcoin ETFs potential approval

Fnality launches the first phase of its Sterling Fnality Payment System

Portfolio Spotlight: Kakarot announced the successful implementation of the EVM in Cairo 1.0

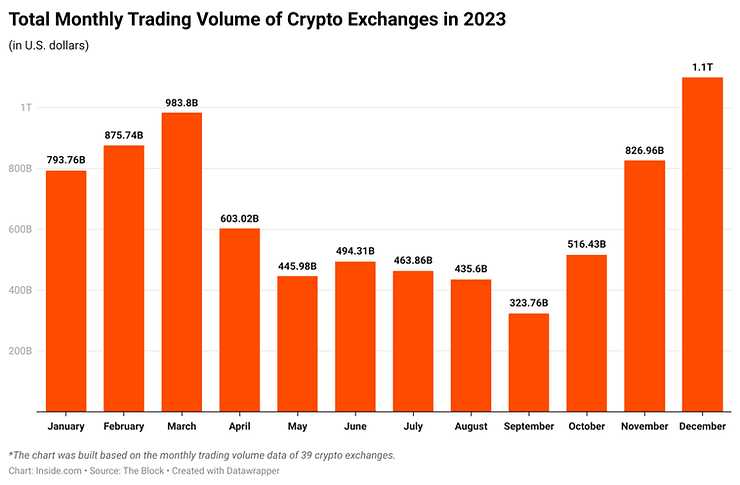

Trading Volumes are Back

With the uptick in the crypto markets, December saw cryptocurrency exchange trading volume of $1.1tn. This marks the first time monthly trading volume has surpassed $1tn since September 2022 and is the highest level reached since May 2022. Binance is still the leading cryptocurrency exchange despite its recent challenges, commanding nearly 40% or $432bn of the total trading volume. Furthermore, asset managers' interest in Bitcoin long futures on the Chicago Mercantile Exchange (CME) has surged to its highest level. The open interest in these futures has grown from $1.04bn at October's end to a record $1.98bn. This figure surpasses the previous peak of $1.67bn, which coincided with Bitcoin's historic high in November 2021 when it reached $68,000.

Potential ETF Approval Upon Us

Spot Bitcoin ETFs have continued to capture the spotlight this month, with the SEC poised to deliver a pivotal ruling on Ark Invest and 21Shares' ETF application by January 10th. Multiple sources have suggested that the SEC will also render decisions on additional ETFs from heavyweights such as BlackRock and Fidelity by the same date. These firms, along with Invesco and others, have recently refined their filings, adding key details that Bloomberg analysts consider among the final steps required for approval. Amidst vigorous debate on the SEC's stance, the consensus among analysts has been leaning toward a favourable outcome. VanEck has ramped up the anticipation with a cryptic social media video featuring the slogans "Buy Bitcoin" and "Born to Bitcoin" fuelling the conversation that a Spot Bitcoin ETF in the US may soon transition from speculation to reality.

Surge in TVL

EigenLayer, a protocol for restaking and crosschain security services on Ethereum, has reached its liquid restaking capacity, catapulting its Total Value Locked (TVL) beyond $1.4bn. This significant increase comes after EigenLayer expanded its restaking capacity in mid-December, which led to a surge in the deposit of Liquid Staking Tokens (LSTs) and ETH into the protocol—a more than fivefold rise from $250m. EigenLayer provides a platform where users can deposit and engage in restaking of ether using a variety of liquid staking tokens. The goal is to redistribute these assets to bolster the security of third-party networks. The protocol's initial phase was successfully rolled out on the Ethereum mainnet in June.

Chainlink, a leading blockchain data-oracle platform, experienced a strong response to its expanded crypto-staking program "V0.2", with over $632m in LINK tokens staked within six hours of the early-access launch. This expansion is part of Chainlink's "Economics 2.0", aimed at bolstering the system's security, and allows both node operators and community members to earn rewards by supporting oracle services with LINK.

UK Paving the Way

Fnality, a London-based blockchain payments firm, officially launched the first phase of live transactions using a digital representation of funds held at the Bank of England. This was done through its Sterling Fnality Payment System (£FnPS) with participation from Lloyds Banking Group, Banco Santander, and UBS. According to the company, the system “brings together for the first time the safety and institutional quality of central bank funds in a systemic wholesale payment system with the innovative functionality and resilience of blockchain technology.” By doing so, Fnality seeks to bridge the gap between mainstream and digital finance to cut the time and cost of settling, managing collateral and making real-time wholesale payments for financial market transactions on a global scale.

The UK has introduced new legislation that enables the Financial Conduct Authority and the Bank of England to create a regulatory sandbox for tokenised securities, known as the Digital Securities Sandbox (DSS). This innovative regulation, effective from January 8th, will facilitate businesses in exploring distributed ledger technology for the digitisation or tokenisation of traditional securities. Participants in the DSS will benefit from tailored regulatory conditions where existing rules may pose obstacles. This initiative is a direct outcome of the Financial Services and Markets Act passed at the end of 2023 and represents a significant step in the UK government's efforts to develop a robust regulatory framework for the crypto sector.

Other News

In other news, IBM has introduced a new cold storage technology for digital assets. Its Hyper Protected Offline Signing Orchestrator is a new cryptographic signing technology that helps protect high-value transactions by offering additional security layers, including disconnected network operations, time-based security, and electronic transaction approval by multiple stakeholders. This new technology is already being used by Ripple-owned custody firm Metaco. Robinhood announced the launch of a crypto trading platform in the EU. The platform will offer over 25 coins to investors and will additionally offer to repay a percentage of customers' trading volumes each month in Bitcoin. Finally, to celebrate a very dominant Formula 1 season and to commemorate the year, Red Bull’s racing team has released a collection of digital collectables minted on the Sui Blockchain. The collectables will feature distinctive art crafted by Automobilist, an award-winning design studio with individuals passionate about creating designs and art around all things motorsport.

Eterna Portfolio Company Spotlight:

Kakarot announced the successful implementation of the EVM in Cairo 1.0

Kakarot, a zero-knowledge Ethereum Virtual Machine (zkEVM) written in Cairo, announced the successful implementation of the EVM in Cairo 1.0. Cairo 0, its initial version, made noteworthy strides in the zero-knowledge sector, but it was initially crafted for StarkWare's internal use, revealing several areas ripe for enhancement. Building on years of insights from Cairo 0, the StarkWare team has introduced Cairo 1.0, boasting significant advancements. Cairo 1.0 has syntax improvements, a new compilation flow through the Sierra intermediate representation, expanded language features (native data structures & error handling), enhanced safety mechanisms, and more. Kakarot, by closely collaborating with StarkWare, has integrated all opcodes within Cairo 1.0. The next steps include assimilating Ethereum tests and ironing out any bugs, paving the way for a fully operational EVM in Cairo 1.0.

Disclaimer: this newsletter was put together for informational purposes only based on our review and analysis. This should not be construed as a solicitation, offer, or recommendation to acquire or dispose of any investment or engage in any transaction.

Share this post